Connect The Pipes

I love this John Gardner1 quote about the dignity of work and excellence.

A society that scorns excellence in plumbing because plumbing is a humble activity and tolerates shoddiness in philosophy because it is an exalted activity will have neither good plumbing nor good philosophy. Neither its pipes nor its theories will hold water.

John Rich put it differently:

If everybody contemplates the infinite instead of fixing the drains, many of us will die of cholera.

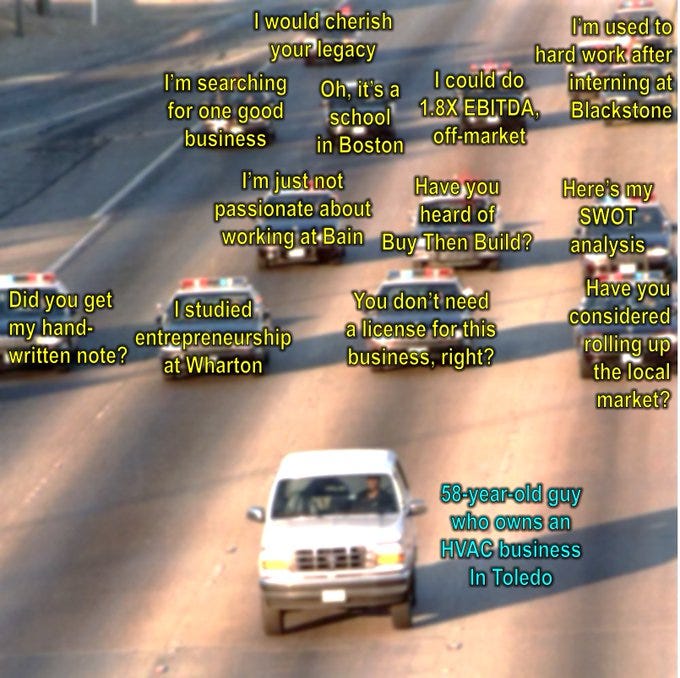

Despite much progress in the past several decades, we still carry many biases. In our status obsessed societies, if you say to your classmates or family upon graduating, ‘I’m going into plumbing’ they will look confused and pitying. On the other hand, if you say ‘I’m going into private equity’, they will likely say ‘oh yes of course, whizkid.’

Here’s a surprising twist — and, I’m not kidding — there are now opportunities at PE firms, where you manage their plumbing or pest control business.

Obviously PE firms do lots of other things — but there is a lot of plumbing nowadays. Here is a WSJ article about private equity plumbing and HVAC businesses:

PE … is no stranger in the skilled trades these days. PE firms across the US have been scooping up home services like HVAC — that is, heating, ventilation and air conditioning — as well as plumbing and electrical companies. They hope to profit by running larger, more profitable operations.

Their growth marks a major shift, taking home-services firms away from family operators by offering mom-and-pop shops seven-figure and eight-figure paydays. It is a contrast from previous generations, when more owners handed companies down to their children or employees.

Here’s my mental model for family businesses: entrepreneurs would start normal businesses, some would succeed and get big, and the entrepreneurs would send their children to business school to learn modern management techniques, and then the children would take over the businesses and manage them professionally.

But sometimes, successful entrepreneurs don’t have children2, or the children don’t want to go into the family business, or they learn nothing useful in business school and run the company into the ground.

Now, the informal hereditary economy of small businesses is being replaced by an efficient market, in which ambitious MBA’s raise money to bid for family businesses, so that they can apply their business-school knowledge, while the heirs get cashed out.Hot Careers

Given the surging investor interest, Alpine Investors founder Graham Weaver says, anyone with entrepreneurial ambitions should take a second look at the trades, which offer steady income via unclogging toilets, fixing boilers and installing new air-cons.

You can build a business that’s going to be worth $10-30 million and have a ready list of buyers to sell it to. Ten years ago, there was no one to sell it to.

SF based Alpine Investors is one of the most sought-after places to work for graduates of top business schools. Driving the demand is Alpine's CEO-In-Training program3, which places MBAs in leading positions at companies within just a few weeks and promises to turn them into actual CEOs in a few years.

Success stories include David Wurtzbacher, who went from Harvard Business School to CFO of Alpine Investor's dental business to founding an Alpine-backed company that is rolling up local CPA firms, in six years.

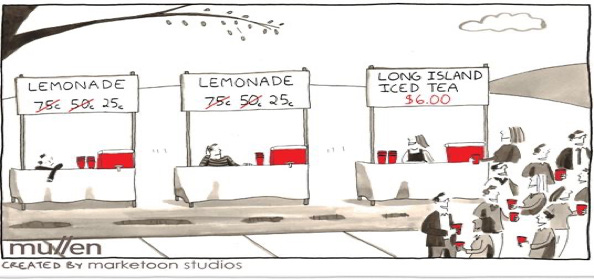

If private equity is going to pay top dollar for plumbing businesses, then arguably the smart move is to be a plumber. Forget the AI/tech start-ups and the 80 hour work weeks.The only downside here is that you and me will shell out more when you call a plumber next — not only do we pay for the service, the PE fund also adds a markup.

Status Over Money

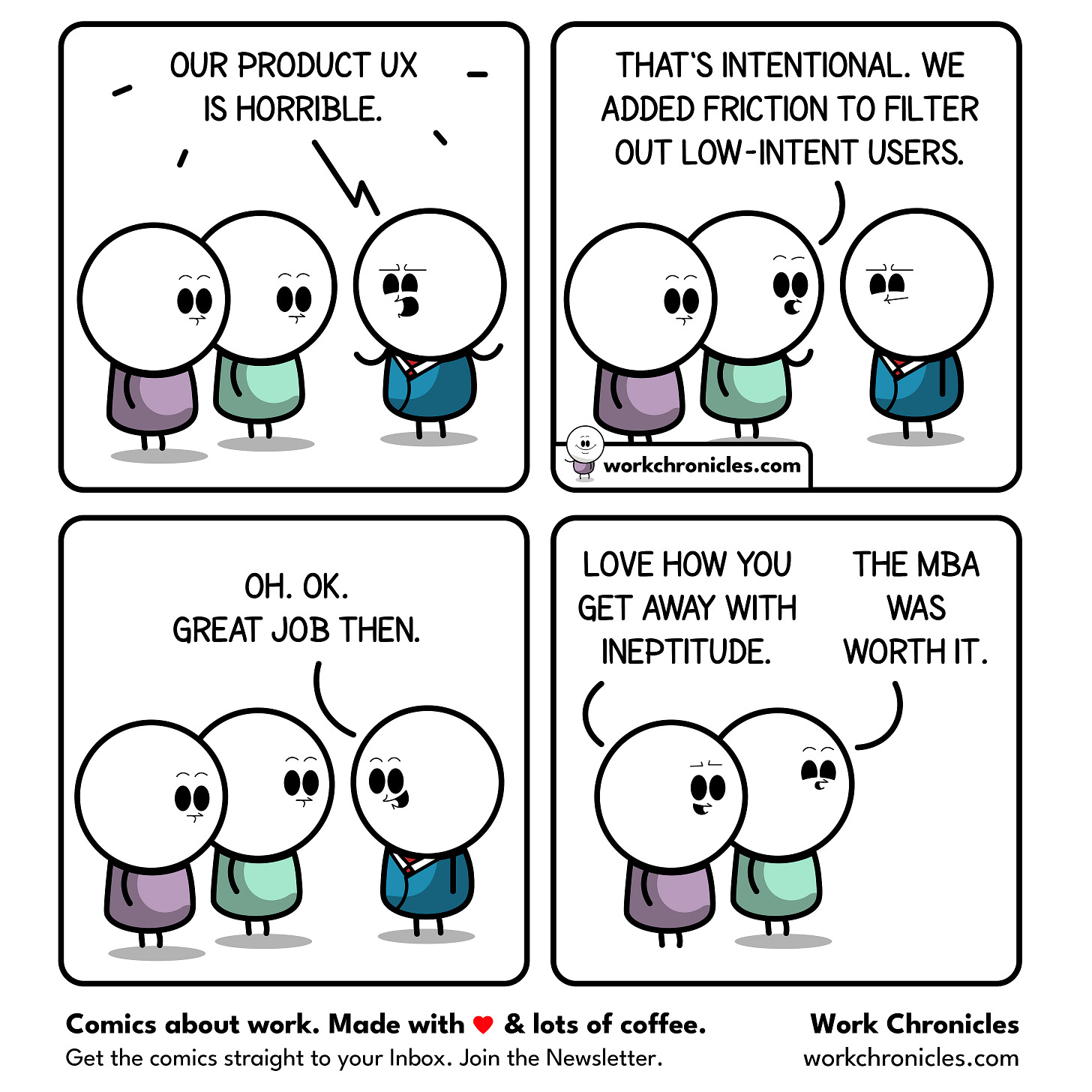

Wrapping service businesses in what sounds like a high-status financial firm rather than a job running a small business appears to be a winning move4.

In a paper led by UC Berkeley psychologist Cameron Anderson, the authors write:

The motivation for status leads people to prefer roles that bestow higher status. In a survey of 1,500 office workers, 7 out of 10 said they would forego a raise for a higher status job title. For example, file clerks preferred receiving the title data storage specialists over receiving a raise. Why was the title preferred over money? … those surveyed believed that other people judged them based on their job title.

70% of people would take a title over money.

I think banks and ad agencies picked this up decades ago — new hires become assistant vice presidents instantly, then associate vice presidents, then senior vice presidents, executive vice presidents and so on5. While status doesn’t appear to be as big a motivator for tech hires, Big Tech innovated with bespoke titles (like Chief Happiness Officer etc) and free perks. For many people, prestige is more valuable than income. Or even job security.

It is puzzling why organizations spend so much time on tweaking financial incentives but relatively little on status incentives. Is this because the latter are more embarrassing to acknowledge?Giorgio Armani, 90, plans to retire in 2 years and is looking for a successor. Let me know.

The firm assesses potential hires' intellectual curiosity, emotional intelligence, and, perhaps most importantly, their ability to handle adversity. Grit is prized above all because even with the ‘sexy’ job title of CEO or CFO, these jobs aren't stereotypically sexy. Instead of power lunches at posh Manhattan steakhouses, Alpine's CEOs in training may be sent to small towns in rural America where they have to get their hands dirty. ‘You're moving from Yale or Harvard to Jackson, Mississippi, to run a plumbing company.’

A recent Harris Poll revealed that 50% of Gen Z and 42% of millennials plan to move into so-called blue-collar jobs like welding, plumbing, or electrical work. As the genAI march picks up speed, 66% of Americans believe trade jobs have more security than corporate ones.

PwC offers ‘managing director’ title to retain staff who will not be partner